UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |   | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to |

INSTEEL INDUSTRIES, INC.

(Name of Registrant as Specified inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee | |

| Fee computed on table below per Exchange Act Rules 14a-6(i) | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

| ||

Dear

Shareholder

H.O. Woltz III Chairman of the Board January 4, 2022 | “Thank you for your |

You are cordially invited to attend the 20202022 Annual Meeting of Shareholders of Insteel Industries Inc. to be held February 11, 202015, 2022 at 9:00 a.m. Eastern Time. The meeting will take place at the Cross Creek Country Club, 1129 Greenhill Road, Mount Airy, North Carolina.

The attached proxy statement and formal notice of the meeting describe the matters expected to be acted upon at the meeting. We urge you to review these materials carefully and to use this opportunity to take part in the Company’s affairs by voting on the matters described in the proxy statement. At the meeting, we will also discuss our operations, fiscal year 20192021 financial results and our plans for the future. Our directors and management team will be available to answer any questions you may have. We hope that you will be able to attend.

Your vote is important to us. Whether you plan to attend the meeting or not, please complete the enclosed proxy card and return it as promptly as possible. If you attend the meeting, you may elect to have your shares voted as instructed inon the proxy card or you may withdraw your proxy at the meeting and vote your shares in person. If you hold shares in “street name” and would like to vote at the meeting, you should follow the instructions provided in the proxy statement.

Thank you for your continued support and interest in Insteel Industries Inc.

Sincerely,

|  | |

Noticeof Annual Meeting | 1373 Boggs Drive Mount Airy, North Carolina 27030 |

FEBRUARY 11, 202015, 2022

9:00 a.m., Eastern Time

Cross Creek Country Club

1129 Greenhill Road

Mount Airy, North Carolina 27030

Dear Shareholder:

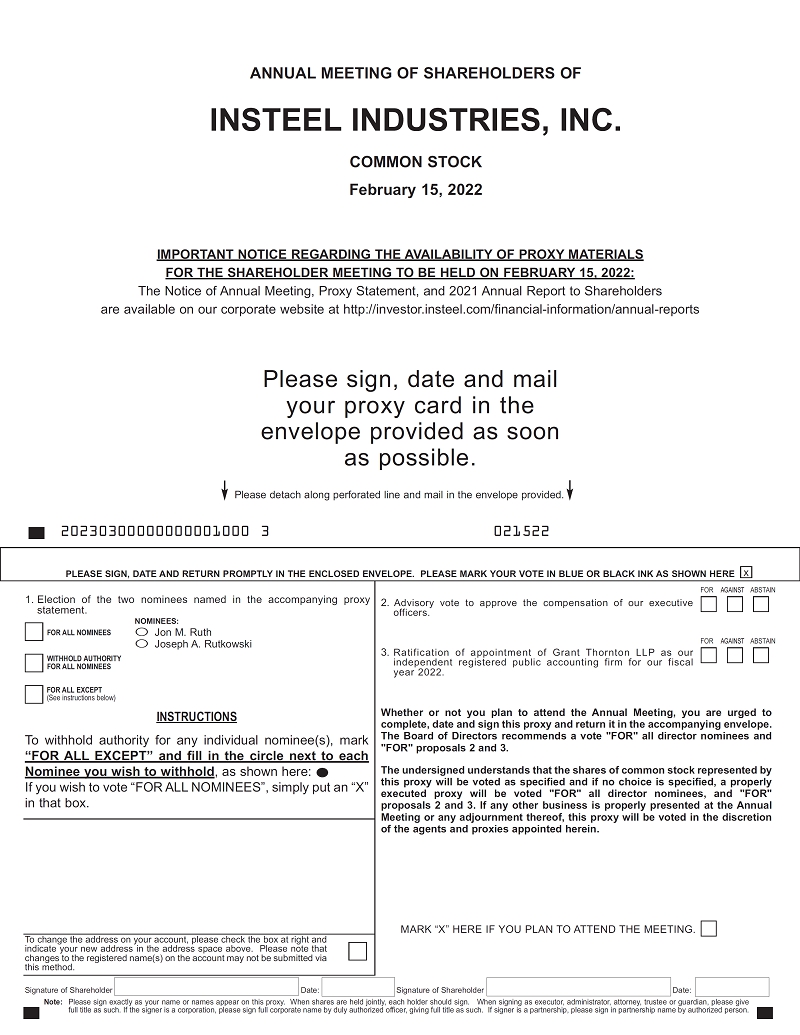

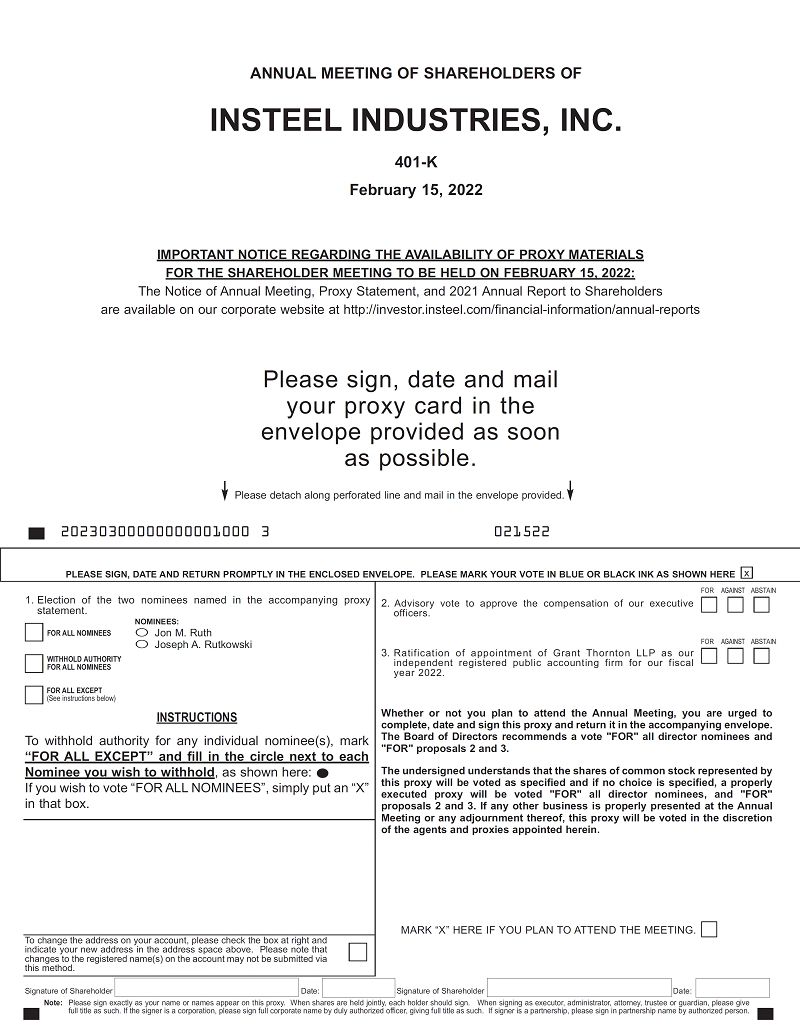

At our Annual Meeting, we will ask you to:

| 1. | Elect |

| 2. | |

| Approve, on an advisory basis, the compensation of our executive officers; | |

| Ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for our fiscal year | |

| Transact such other business, if any, as may properly be brought before the meeting or any adjournment thereof. |

Only shareholders of record at the close of business on December 11, 201915, 2021 are entitled to vote at the Annual Meeting and any adjournment or postponement thereof.

Whether or not you plan to attend the meeting and vote your common stock in person, please mark, sign, date and promptly return the enclosed proxy card or voting instruction form in the postage-paid envelope according to the instructions printed on the card. Any proxy may be revoked at any time prior to its exercise by delivery of a later-dated proxy or by properly voting in person at the Annual Meeting.

Enclosed is a copy of our Annual Report for the year ended September 28, 2019,October 2, 2021, which includes a copy of our Annual Report on Form 10-K filed with the Securities and Exchange Commission.

By Order of the Board of Directors

James F. Petelle

Vice President and Secretary

January 3, 20204, 2022

Mount Airy, North Carolina

| Table | |

of Contents

| INSTEELINDUSTRIES INC. | | 5 | ||||

This summary highlights certain information that is described in more detail elsewhere in this proxy statement. This summary does not contain all the information you should consider before voting on the issues at our Annual Meeting,annual meeting, so we ask that you read the entire proxy statement carefully. Page references are provided to help you quickly find further information.

20202022 Annual Meeting of Shareholders

| Date and Time: | February |

| 9:00 a.m. Eastern Time | |

| Place: | Cross Creek Country Club |

| 1129 Greenhill Road | |

| Mount Airy, NC 27030 |

You can vote at our annual meeting if you were a shareholder of record of our common stock at the close of business on December 11, 2019.15, 2021.

We are committed to high standards of corporate governance, and our Board is committed to acting in the long-term best interests of our shareholders. Our Nominating and Governance Committee continually reviews our policies and practices in light of recent trends in corporate governance, but with its primary focus on the long-term interest of shareholders. Below is a summary of our corporate governance highlights with respect to our Board of Directors.

| • | Six out of our seven directors are independent. |

| • | Our Lead Independent Director leads executive sessions of the independent directors, which are held in conjunction with each regularly scheduled |

| • | We require that a nominee for director submit a resignation to the Board if he or she fails to receive a majority of the shares voted in an uncontested election. |

| • | We maintain fully independent Audit, Compensation and Nominating and Governance Committees. |

| • | We have share ownership guidelines for directors and executive officers. |

| • | Our directors and executive officers are prohibited from hedging our stock and are required to obtain prior approval of any pledge of our stock. |

| • | We |

| • | Our Board participates in annual director education programs. |

| • | We require prior approval of certain related party transactions and |

| Information about our corporate governance policies and practices can be found at pp. 9-13. |

VOTING MATTERS

| Vote Required | Board Recommendation | |||

| Proposal 1: Election of | Directors | Plurality of Votes Cast* | FOR all nominees | |

| Proposal 2: | ||||

| officers | Majority of the Votes Cast | FOR | ||

| Proposal | 2022. | Majority of the Votes Cast | FOR |

| * | Although a director will be elected by a plurality of the votes cast, if the director receives less than a majority of the shares voted in an uncontested election (such as this one), the director is required to submit his or her resignation to the Board. See “Board Governance Guidelines” on |

| www.insteel.com | INSTEELINDUSTRIES INC. | | ||||

We typically elect approximately one-third of our directors each year to serve three-year terms. Our Board of Directors currently consists of seven directors. We are seeking shareholder approval for threetwo director nominees: Abney S. Boxley III, AnneJon M. LloydRuth and W. Allen Rogers II, allJoseph A. Rutkowski, each of whom have been nominated for three-year terms.

| Information about our director nominees, continuing directors and executive officers can be found at pp. 16-19. |

Approval of an Amendment to the 2015 Equity Incentive Plan

At our 2015 annual meeting, our shareholders approved the 2015 Equity Incentive Plan of Insteel Industries Inc., (“2015 Plan”) pursuant to which we may issue 900,000 shares of our common stock, of which only 350,000 shares could be used for “full-value” grants. We are now proposing to amend the 2015 Plan to add an additional 750,000 shares for use thereunder, of which only 250,000 could be used for full-value awards.

Advisory Vote on the Compensation of our Executive Officers

Our executive compensation program emphasizes performance-based compensation, so the amount of compensation paid to our executive officers varies significantly based on our financial performance. We seek primarily to build long-term shareholder value, and therefore we base the payment of annual cash bonuses on our return on capital, a metric that has been shown to be closely associated with long-term growth in shareholder value. Compensation practices include:

| Stock ownership |

| Double triggers in our change in control severance |

| Clawback |

| No significant |

| Prohibition of hedging of our |

| |

| Prohibition of stock option |

| Information about our executive compensation program can be found in the “Compensation Discussion and Analysis” at pp. |

Ratify the Appointment of Grant Thornton LLP as our Independent Public Accounting Firm for Fiscal 20202022

| Information concerning our independent public accounting firm, including the fees we paid |

| INSTEELINDUSTRIES INC. | | 7 | ||||

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on February

The Notice of Annual Meeting of Shareholders, Proxy Statement |

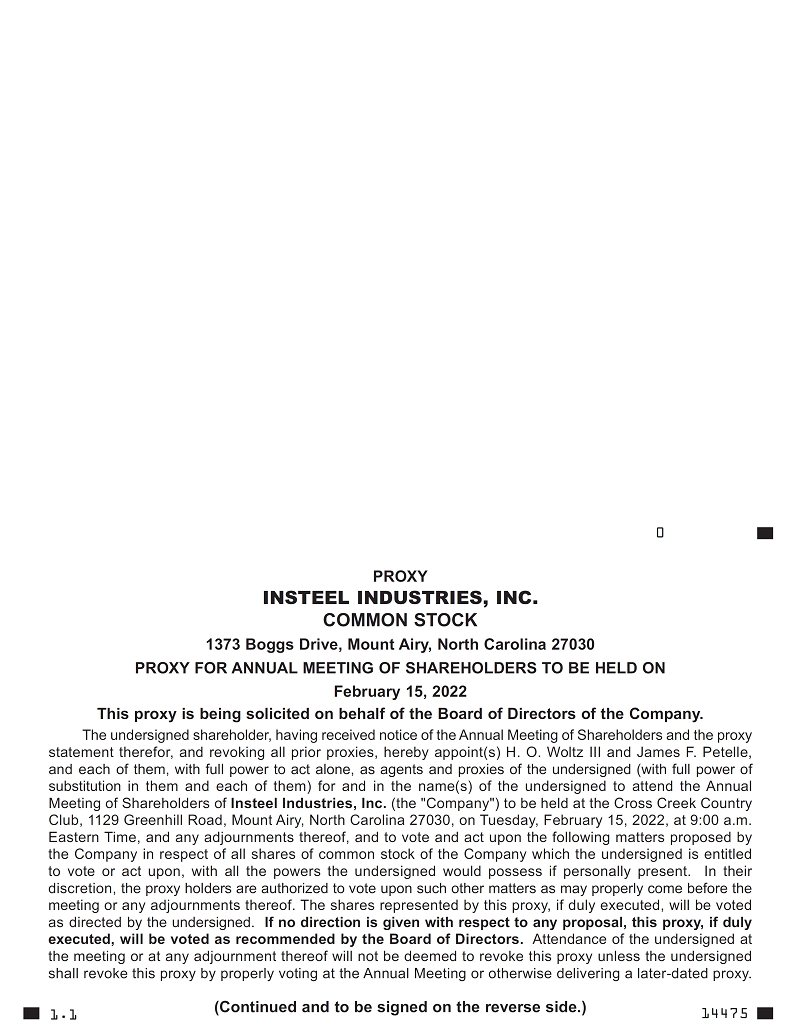

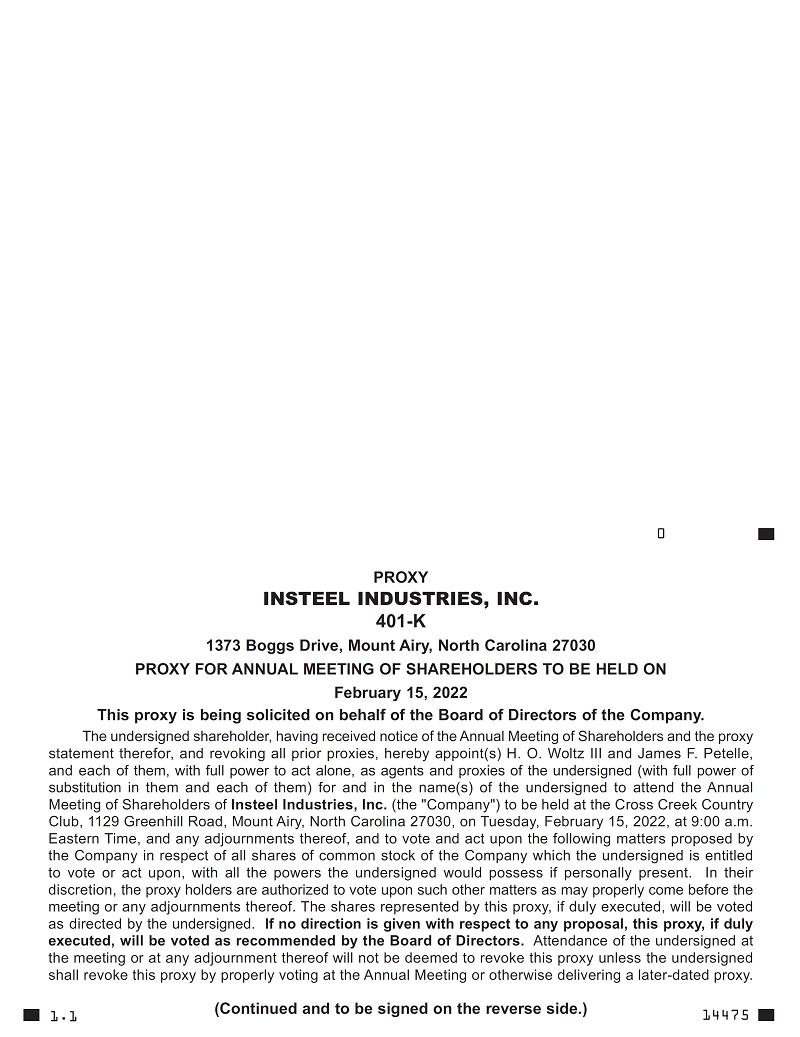

This proxy statement is furnished in connection with the solicitation of proxies by our Board of Directors for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on February 11, 202015, 2022 at 9:00 a.m., Eastern Time, and at any adjournments or postponements of the Annual Meeting. The meeting will take place at the Cross Creek Country Club, 1129 Greenhill Road, Mount Airy, North Carolina. This proxy statement, accompanying proxy card and the 20192021 Annual Report, which includes a copy of our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”), are first being mailed or made available to our shareholders on or about January 3, 2020.4, 2022.

This proxy statement summarizes certain information you should consider before you vote at the Annual Meeting. However, you do not need to attend the Annual Meeting to vote your shares. If you do not expect to attend or prefer to vote by proxy, you may follow the voting instructions on the enclosed proxy card. In this proxy statement, Insteel Industries Inc. is generally referred to as “we,” “our,” “us,” “Insteel Industries,” “Insteel” or “the Company.”

The enclosed proxy card indicates the number of shares of Insteel common stock that you own as of the record date of December 11, 2019.15, 2021. In this proxy statement, outstanding shares of Insteel common stock (no par value) areis sometimes referred to as the “Shares.”

Website addresses and hyperlinks are included for reference only. The information contained on or available through websites referred to and/or linked to in this proxy statement (other than the Company’s website to the extent specifically referred to herein as required by SEC rules) is not part of this proxy solicitation and is not incorporated by reference into this proxy statement or any other proxy materials.

| www.insteel.com | INSTEELINDUSTRIES INC. | | |||||

Corporate Governance Guidelines and Board Matters

Our bylaws provide that our Board of Directors will have not less than five nor more than 10 directors, with the precise number to be established by resolution of the Board from time to time. Since the addition of Ms. Lloyd to our Board on April 16, 2019, weWe currently have seven directors. Our Nominating and Governance Committee annually considers whether the size of the Board is optimal, given its workload,work-load, the Committees on which directors serve and the Company’s size and complexity.

The Board of Directors oversees our business affairs and monitors the performance of management. In accordance with basic principles of corporate governance, the Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chairman, our Lead Independent Director,lead independent director, key executive officers and our principal external advisers (legal counsel, auditors, investment bankers and other consultants), by reading reports and other materials that are sent to them and by participating in Board and committee meetings.

At its meeting on August 25, 2009, the Board of Directors adopted Board Governance Guidelines, which were amended most recently on August 13, 2019.May 18, 2021. The Board Governance Guidelines are available on our website at http:https://investor.insteel.com/documents.cfm.corporate-governance/governance-documents.

The Board of Directors, at its meeting on November 12, 2019,16, 2021, determined that the following members of the Board, which constitute a majority thereof, each satisfy the definition of “independent director,” as that term is defined under the Nasdaq Global Select MarketNew York Stock Exchange (“Nasdaq”NYSE”) listing standards: Abney S. Boxley, Anne H. Lloyd, W. Allen Rogers II, Jon M. Ruth, Joseph A. Rutkowski and G. Kennedy Thompson. Our Chairman and Chief Executive Officer, H.O. Woltz III, is currently our only non-independent director. In addition to considering the objective independence criteria established by Nasdaq,NYSE, the Board also made a subjective determination as to each of these directors that no transactions, relationships or arrangements exist that, in the opinion of the Board, would interfere with the exercise of the director’s independent judgment in carrying out his or her responsibilities as one of our directors. In making these determinations, the Board reviewed information provided by the directors and us with regard to each director’s business and personal activities as they may relate to us and our management.

Directors are expected to attend all meetings of the Board of Directors and all meetings of Board committees on which they serve. The independent directors meet in executive session with no members of management present before or after each regularly scheduled meeting (see “Executive Sessions” below). The Board of Directors met four times in fiscal 2019.2021. Each director attended at least 75% of the meetings of the Board and committees on which he or she served during fiscal 2019.2021.

Director Attendance at Annual Meetings

The Board has determined that it is in our best interest for all members of the Board of Directors to attend the Annual Meeting of Shareholders. All members of our Board of Directors attended our 20192021 annual meeting.

The Audit Committee

The Board has an Audit Committee, which assists the Board in fulfilling its responsibilities to shareholders concerning our accounting, financial reporting and internal controls, and facilitates open communication between the Board, outside auditors and management. The Audit Committee discusses the financial information prepared by management, our internal controls and our audit process with management and with outside auditors. The Audit Committee is charged with the responsibility of selecting our independent registered public accounting firm. The independent registered public accounting firm meets with the Audit Committee (both with and without the presence of management) to review and discuss various matters pertaining to the audit process,

including our financial statements, the scope and terms of its work, the results of its

| INSTEELINDUSTRIES INC. | 2022 Proxy Statement | 9 | |||

year-end audit and quarterly reviews, and its recommendations concerning the financial practices, controls, procedures and policies we employ. The Board has adopted a written charter for the Audit Committee as well as a Pre-Approval Policy regarding all audits, audit-related, tax and other non-audit related services to be performed by the independent registered public accounting firm.

The Audit Committee is a separately-designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that consists of Ms.directors Lloyd, and Messrs. Rogers and Thompson. Mr. RogersThompson served as Chairmanchair of the Audit Committee until December 1, 2018, after which Mr. Thompson served as Chair of the Audit Committee for the balance ofduring fiscal 2019.2021. The Board, at its meeting in November 2019,2021, determined that each of the members of the Audit Committee meets the definition of “independent director” and satisfies certain audit committee-specific independence requirements under NasdaqNYSE rules and SEC requirements. At the same meeting, the Board also determined that each of Mr. Rogers, Mr. Thompson and Ms. Lloyd qualify as an “Audit Committee Financial Expert” as defined under SEC rules. The Board of Directors has also determined that each of the Audit Committee members is financially literate as such qualification is interpreted in the Board’s judgment. The functions of the Audit Committee are further described herein under “Report of the Audit Committee.”

The Audit Committee met six times during fiscal 2019,2021, and members of the Audit Committee consulted with management of the Company, the internal auditor and the independent registered public accounting firm at various times throughout the year. The charter for the Audit Committee, as most recently revised November 12, 2019,on February 16, 2021, is available on our website at http:https://investor.insteel.com/documents.cfm.corporate-governance/ governance-documents.

The Executive Compensation Committee

The Executive Compensation Committee is responsible for (i) determining appropriate compensation levels for our executive officers, including any employment, severance or change in control arrangements; (ii) evaluating officer and director compensation plans, policies and programs; (iii) reviewing benefit plans for officers and employees; and (iv) producing an annual report on executive compensation for inclusion in the proxy statement.

The Executive Compensation Committee Report is included in this proxy statement. The Executive Compensation Committee also reviews, approves and administers our incentive compensation plans and equity-based compensation plans and has sole authority for making awards under such plans, including their timing, valuation and amount. In addition, the Executive Compensation Committee reviews and recommends the structure and level of outside director compensation to the full Board. The Executive Compensation Committee has the discretion to delegate any of its authority to a subcommittee, but did not do so during fiscal 2019.2021. The Executive Compensation Committee is chaired by Mr. Ruth and includes directors Boxley, Lloyd, Rutkowski and Thompson. The Executive Compensation Committee met oncethree times during fiscal 2019.2021. At its meeting in November 2019,2021, the Board of Directors determined that each of the members of the Executive Compensation Committee meets the definition of “independent director” and certain compensation committee-specific independence requirements under NasdaqNYSE rules and SEC requirements. The charter of the Executive Compensation Committee, as most recently revised on November 12, 2019,February 16, 2021, is available on our website at http:https://investor.insteel.com/documents.cfm.corporate-governance/governance-documents.

The Executive Compensation Committee consults with members of our executive management team on a regular basis regarding our executive compensation program. Our executive compensation program, including the role members of our executive management team and outside compensation consultants play in assisting with establishing compensation, is discussed in more detail below under “Executive Compensation -Compensation- Compensation Discussion and Analysis.” Our Executive Compensation Committee has retained Pearl Meyer & Partners, LLC to serve as its outside consultant.consultant during fiscal 2021.

The Nominating and Governance Committee

The Nominating and Governance Committee is responsible for establishing Board membership criteria, identifying individuals qualified to become Board members consistent with such criteria and recommending nominations of individuals for nomination for director when openings exist, recommending the appointment of Board committee members and chairs, and reviewing corporate governance issues. Specifically, this Committee periodically reviews our classified board structure, our director election qualifications and procedures, and makes recommendations as appropriate to our Board.

The Committee also reviews and recommends changes as necessary to the Board Governance Guidelines and our Code of Business Conduct and facilitates an annual Board self-assessment process.

The Nominating and Governance Committee, which consists of Messrs. Rogers, Boxley, Ruth and Rutkowski, met four times during fiscal 2019.2021. The Nominating and Governance Committee was chaired by Mr. Rutkowski during fiscal 2019.2021. The Board of Directors, at its meeting in November 2019,2021, determined that each of the members of the Nominating and Governance Committee meets the definition of “independent director” as that term is defined under NasdaqNYSE rules. The charter of the Nominating and Governance Committee, as most recently revised on October 2, 2017,February 16, 2021, is available on our website at http:https://investor.insteel.com/documents.cfm.corporate-governance/governance-documents.

| www.insteel.com | INSTEELINDUSTRIES INC. | | |||||

Pursuant to the listing standards of Nasdaq,NYSE, the independent directors are required to meet regularly in executive sessions. Generally, those sessions are chaired by the Lead Independent Director.lead independent director. During fiscal 2019,2021, the Lead Independent Directorlead independent director was W. Allen Rogers.Rogers II. During the Board’s executive sessions, the Lead Independent Directorlead independent director has the power to lead the meeting, set the agenda and determine the information to be provided. During fiscal 2019,2021, the Board held four executive sessions.

The Lead Independent Directorlead independent director can be contacted by writing to Lead Independent Director, Insteel Industries Inc., c/o James F. Petelle, Secretary, 1373 Boggs Drive, Mount Airy, North Carolina 27030. We screen mail addressed to the Lead Independent Directorlead independent director for security purposes and to ensure that it relates to discrete business matters that are relevant to the Company. Mail that satisfies these screening criteria will be forwarded to the Lead Independent Director.lead independent director.

In conjunction with the Board’s establishment of the Nominating and Governance Committee in 2009, the Board adopted Board Governance Guidelines to set forth the framework pursuant to which the Board governs the Company. Among other things, the Board Governance Guidelines describe the expectations regarding attendance at the Annual Meeting and at Board Meetings,meetings, require regular meetings of independent directors in executive session, describe the functions of the Board’s standing committees, including an annual self-assessment process facilitated by the Nominating and Governance Committee, and set forth the procedure pursuant to which shareholders may communicate with directors. Our Board Governance Guidelines and the charter of our Nominating and Governance Committee were amended on October 2, 2017 to provide that a director who fails to receive a majority of the shares voted in an uncontested election shall tender his or her resignation to the board, within 10 days of the certification of election results. The Nominating and Governance Committee will consider the tendered resignation and recommend to the Board the action to be taken with respect to the resignation. The Board will act on the tendered resignation, taking into account such recommendation, and publicly disclose its decision regarding the tendered resignation within 90 days from the date of the certification of the election results.

Our CEO also serves as Chairman of our Board of Directors, and we have a Lead Independent Director.lead independent director. The Board has determined that this structure is appropriate because it believes that at this time it is optimal to have one person speak for and lead the Company and the Board, and that the CEO should be that person. We believe that our Lead Independent Directorlead independent director position, the number and strength of our independent directors and our overall governance practices minimize any potential conflicts that otherwise could result from combining the positions of Chairman and CEO.

The Lead Independent Directorlead independent director presides at meetings of our independent directors, which are held prior to or following all of our regularly scheduled Board Meetings.meetings. As noted above, the Lead Independent Directorlead independent director may call for other meetings of the independent directors or of the full Board if he deems it necessary. The Lead Independent Directorlead independent director also consults with the Chairman regarding meeting agendas, and serves as the principal liaison between the independent directors and the Chairman.

Our Board has overall responsibility for risk oversight. The Board as a whole exercises its oversight responsibilities with respect to strategic, operational and competitive risks, as well as risks related to crisis management and executive succession issues. The Board has delegated oversight of certain other types of risks to its committees. The Audit Committee oversees our policies and processes related to our financial statements and financial reporting, risks relating to our capital, credit and liquidity status, and risks related to related person transactions. The Executive Compensation Committee oversees risks related to our compensation programs and structure, including our ability to motivate and retain talented executives.executives and other employees. The Nominating and Governance Committee oversees risks related to our governance structure and succession planning for Board membership. Beginning in fiscal 2010, we instituted a formal process in which the major business risks facing the company are identified and assessed, and appropriate strategies are identified to respond to such risks. This risk assessment process is conducted and reviewed with the Board on an ongoing basis.

The Board believes that its ability to oversee risk is enhanced by having one person serve as the Chairman of the Board and CEO. With his in-depth knowledge and understanding of the Company’s operations, Mr. Woltz as Chairman and CEO is better able to bring key strategic and business issues and risks to the Board’s attention than would a non-executive Chairman of the Board.

| INSTEELINDUSTRIES INC. | | 11 | ||||

Consistent with the Board’s commitment to sound corporate governance, the Board adopted a Code of Business Conduct (the “Code of Conduct”) in 2003, which applies to all of our employees, officers and directors. The Code of Conduct was amended on February 16, 2021. The Code of Conduct incorporates an effective reporting and enforcement mechanism. The Board has adopted this Code of Conduct as its own standard. TheWe adopted the Code of Conduct was prepared to help employees, officers and directors understand our standard of ethical business practices and to promote awareness of ethical issues that may be encountered in carrying out their responsibilities. TheWe include the Code of Conduct is included in an employment manual, which is supplied to all of our employees and officers and in a Board of Directors Manual for directors, each of whom are expected to read and acknowledge in writing that they understand such policies.the policies set forth in the Code.

We have had stock ownership guidelines that apply to our directors and executive officers since 2011.officers. Under the guidelines, the CEO is expected to own Company stock valued at three times his annual salary, while our other executive officers are expected to own stock valued at one-and-one-half times their annual salary. A newly-appointed executive officer would have five years to comply from the date upon which he or she becomes covered under the guidelines. Directors are required to own three times their annual cash retainers, and have three years from the date they joined the Board in which to comply. All directors and executive officers and all directors with at least three years ofwho have the respective minimum service on the Board,times in their positions are in compliance with our guidelines.

Policy Regarding Hedging or Pledging of Insteel Stock

We also have a policy prohibiting Insteel directors and officers who are subject to Section 16 reporting requirements (“Section 16 Officers”) from entering into financial transactions designed to hedge or offset any decrease in the market value of our stock. In addition, the policy requires that directors and Section 16 Officers pre-disclose to the Board any intention to enter into a transaction involving the pledge or other use of our stock as collateral to secure personal loans. As of the record date, December 11, 2019,15, 2021, no current directors or Section 16 Officers have pledged any shares of Insteel common stock.Common Stock.

Availability of Bylaws, Board Governance Guidelines, Code of Conduct and Committee Charters

Our Bylaws, Board Governance Guidelines, Code of Business Conduct, Audit Committee Charter, Audit Committee Pre-Approval Policy, Executive Compensation Committee Charter and Nominating and Governance Committee Charter are available on our website at http:https://investor.insteel.com/documents.cfm,corporate-governance/governance-documents, and in print to any shareholder upon written request to our Secretary.

We are committed to operating our business responsibly and creating long-term value for our shareholders. We fulfill our commitment to creating long-term value by striving to operate our business in a sustainable way, since long-term success requires that we maintain a healthy and satisfied workforce, protect the environment of the communities in which we operate and conserve natural resources.

Our Board and Board committees review with management our programs related to maintenance of safe operations of our workforce, management succession, compensation and benefits, compliance with legal and regulatory requirements, compliance with our Code of Conduct and other topics relevant to the responsible and sustainable operation of the Company. Safe operations with zero harm to employees, the environment and Company assets is a key goal and is the first item covered at our meetings of senior management and the first item covered in

| www.insteel.com | INSTEELINDUSTRIES INC. | 2022 Proxy Statement | 12 | ||

each business operations report that management provides at board meetings. While we are proud that we maintain an OSHA recordable injury average significantly lower than the average for our industry, we continually strive to attain our goal of zero harm.

We have continued to operate our factories and our business during the global COVID-19 pandemic. While we instituted numerous safety protocols and made substantial changes in many aspects of our business, we had no significant furloughs or reductions in force due to the pandemic, and in fact increased our total employment from 881 at the beginning of fiscal 2021 to 913 at the end of fiscal 2021. On July 13, 2021, we announced that, in recognition of the work of our employees during the pandemic, a special award of $1,000 would be paid to substantially all of our employees on December 3, 2021.

For additional information on our approach to environmental and human capital issues, please see our website at www.insteel.com and our Annual Report on Form 10-K for fiscal 2021.

Shareholder Recommendations and Nominations

The Nominating and Governance Committee Charter provides that the Committee will review the qualifications of any director candidates that have been properly recommended to the Committee by shareholders. Shareholders should submit any such recommendations in writing c/o Insteel Industries Inc., 1373 Boggs Drive, Mount Airy, North Carolina 27030, Attention: James F. Petelle, Vice President and Secretary. In addition, in accordance with our bylaws, any shareholder entitled to vote for the election of directors at the applicable meeting of shareholders may nominate persons for election to the Board if such shareholder complies with the notice procedures set forth in the bylaws and summarized in “Shareholder Proposals for the 20212023 Annual Meeting” below.

Process for Identifying and Evaluating Director Candidates

Pursuant to its charter and our Board Governance Guidelines, the Nominating and Governance Committee is responsible for developing and recommending to the Board criteria for identifying and evaluating candidates to serve as directors. The Committee believes that Insteel benefits by fostering a mix of experienced directors with a deep understanding of our industry, including its highly cyclical nature, and who will represent the long-term interests of our shareholders. The criteria considered by the committee in evaluating potential candidates for director include:

| • | Independence; |

| • | Leadership experience; |

| • | Business and financial experience; |

| • | Familiarity with our industry, customers and suppliers; |

| • | Integrity; |

| • | Diverse talents, backgrounds and perspectives; |

| • | Judgment; |

| • | Other company board or management relationships; |

| • | Existing time commitments; and |

| • |

The Board seeks to ensure that its membership consists of directors who have diverse backgrounds, experience and viewpoints,view-points that are relevant in the context of our highly cyclical and competitive business but does not have a formal policy onwritten diversity policy.

The Board shares the concern of many institutional shareholders concerning Board diversity as itthat term relates to race, ethnicity, gender or national origin.

The Nominating and Governance Committee periodically assesses whetherother factors. While one director is considered diverse today, the numberCompany has a long history of directorsboard diversity that predates the recent high profile of this issue. One diverse board member served for 24 years prior to her retirement and the other passed away unexpectedly after 19 years of Board service. Each of these diverse individuals was selected for Board service based on leadership skills, integrity and proven performance managing in highly cyclical industries. There is currently not an opening on our Board, is appropriate and whether any vacancies are anticipated due to retirement or other reasons. Thethe Board does not have a formal policy on age or lengthbelieve it is in the best interests of service for directors.

The Committee works withshareholders to expand the Chairmansize of the BoardBoard. As we plan for director succession, we are committed to identify and recruita process of identifying diverse candidates who are qualified director candidates in accordance with the director qualifications set forth into serve on our Board Governance Guidelines, and also may retain a third party search firm to assist in the identification of possible candidates for election to the Board. In addition, the Committee will consider any director candidates that have been properly recommended to the Committee by our shareholders or directors. Upon the recommendation of the Committee, the Board evaluates each director candidate based upon the totality of the merits of each candidate as well as the needs of the Board, and not based on minimum qualifications or attributes.

When considering a director candidate standing for re-election, in addition to the above criteria, the Board will also consider that individual’s past contribution and future commitment to us. Upon completion of discussions by the full Board regarding the candidates recommended by the Committee, the Board determines, as applicable, whether to (i) approve and recommend one or more candidates to the shareholders for election at the applicable annual meeting, or (ii) elect one or more candidates to fill vacated or newly created positions on the Board.

Communications with the Board of Directors

The Board has approved a process for shareholders to send communications tocommunicating with the Board. Shareholders and interested parties can send communications to the Board and, if applicable, to any of its committees or to specified individual directors in writing c/o Insteel Industries Inc., 1373 Boggs Drive, Mount Airy, North Carolina 27030, Attention: James F. Petelle, Vice President and Secretary.

We screen mail addressed to the Board, its Committees or any specified individual director for security purposes and to ensure that the mail relates to discrete business matters that are relevant to our Company. Mail that satisfies these screening criteria is required to be forwarded to the appropriate director or directors.

| INSTEELINDUSTRIES INC. | | 13 | ||||

Security Ownership of Certain Beneficial Owners

On the record date, December 11, 2019,15, 2021, to our knowledge, no one other than the shareholders listed below beneficially owned more than 5% of the outstanding shares of our common stock.

| Name and Address of Beneficial Owner | Number of Shares | Percentage of Shares |

| BlackRock, Inc. and affiliates(1) 55 East 52nd Street New York, New York 10055 | 2,692,847 | 14.0% |

| Royce & Associates, LP(2) 745 Fifth Avenue New York, New York 10151 | 1,964,043 | 10.2% |

| Dimensional Fund Advisors LP(3) Building One 6300 Bee Cave Road Austin, Texas 78746 | 1,338,441 | 6.9% |

| The Vanguard Group(4) 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | 1,175,744 | 6.1% |

| Name and Address of Beneficial Owner | Number of Shares | Percentage of Shares | ||

| BlackRock, Inc. and affiliates(1) 55 East 52nd Street New York, NY 10055 | 3,009,149 | 15.5% | ||

| Franklin Mutual Advisers, LLC and affiliates(2) 101 John F. Kennedy Parkway Short Hills, NJ 07078-2789 | 1,543,224 | 8.0% | ||

| T. Rowe Price Associates, Inc.(3) 100 E. Pratt Street Baltimore, MD 21202 | 1,341,037 | 6.9% | ||

| The Vanguard Group(4) 100 Vanguard Blvd. Malvern, PA 19355 | 1,220,212 | 6.3% | ||

| Dimensional Fund Advisors LP(5) Building One 6300 Bee Cave Road | 1,162,496 | 6.0% |

| (1) | Based upon information set forth in a Schedule |

| (2) | Based upon information set forth in a Schedule 13G/A filed with the SEC by |

| (3) | Based upon information set forth in a Schedule 13G/A filed with the SEC by |

| (4) | Based upon information set forth in a Schedule 13G/A filed with the SEC by The Vanguard Group on February |

| (5) | Based upon information set forth in a Schedule 13G/A filed with the SEC by Dimensional Fund Advisors LP on February 12, 2021 reporting that it or its subsidiaries may possess sole power to vote or direct the vote of 1,103,002 shares and sole power to dispose or direct the disposition of 1,162,496 shares. Dimensional Fund Advisors LP and its subsidiaries disclaimed beneficial ownership of such shares. |

| www.insteel.com | INSTEELINDUSTRIES INC. | | |||||

Security Ownership of Directors and Executive Officers

The following table shows the number of shares of our common stock, beneficially owned on December 11, 2019,15, 2021, the record date, by each of our directors, each of our executive officers, and by all such directors and executive officers as a group. The table also shows the number of restricted stock units (“RSUs”) held by each individual and the number of shares of our common stock that each individual had the right to acquire by exercise of stock options within 60 days after the record date. Beneficial ownership is determined in accordance with the rules of the SEC. Except as indicated in the footnotes to this table and under applicable community property laws, each shareholder named in the table has sole voting and dispositive power with respect to the shares set forth opposite the shareholder’s name. The address of all listed shareholders is c/o Insteel Industries Inc., 1373 Boggs Drive, Mount Airy, North Carolina 27030.

| Shares of Common Stock | RSUs(1) | Options Exercisable Within 60 days | Total | % | ||||||

| Abney S. Boxley III | 5,000 | 2,782 | 5,000 | * | ||||||

| Anne H. Lloyd | 0 | 0 | 0 | * | ||||||

| W. Allen Rogers II | 79,734 | 2,782 | 79,734 | * | ||||||

| Jon M. Ruth | 8,133 | 2,782 | 8,133 | * | ||||||

| Joseph A. Rutkowski | 8,121 | 2,782 | 8,121 | * | ||||||

| G. Kennedy Thompson | 17,684 | 2,782 | 17,684 | * | ||||||

| H. O. Woltz III(2) | 687,258 | 33,463 | 49,358 | 736,616 | 3.8 | |||||

| Michael C. Gazmarian | 31,006 | 15,338 | 25,840 | 56,846 | * | |||||

| James F. Petelle | 16,826 | 8,367 | 11,833 | 28,659 | * | |||||

| Richard T. Wagner | 30,234 | 15,338 | 19,872 | 50,106 | * | |||||

| All Directors and Executive Officers as a Group (10 Persons) | 883,996 | 106,903 | 990,899 | 5.1 |

| Number of | Options | |||||||||

| Shares of | Exercisable | |||||||||

| Name of Beneficial Owner | Common Stock | RSUs(1) | Within 60 days | Total | % | |||||

| Abney S. Boxley, III | 10,498 | 2,039 | 10,498 | |||||||

| Anne H. Lloyd | 2,716 | 2,039 | 2,716 | * | ||||||

| W. Allen Rogers II | 85,232 | 2,039 | 85,232 | * | ||||||

| Jon M. Ruth | 13,631 | 2,039 | 13,631 | * | ||||||

| Joseph A. Rutkowski | 13,619 | 2,039 | 13,619 | * | ||||||

| G. Kennedy Thompson | 23,182 | 2,039 | 23,182 | * | ||||||

| H. O. Woltz III(2) | 668,874 | 38,196 | 70,899 | 739,773 | 3.8 | |||||

| Mark A. Carano | 0 | 6,764 | 2,354 | 2,354 | * | |||||

| James F. Petelle | 17,746 | 9,550 | 13,389 | 31,135 | * | |||||

| Richard T. Wagner | 35,133 | 17,506 | 54,432 | 89,565 | * | |||||

| James R. York | 468 | 7,003 | 11,728 | 12,196 | * | |||||

| All Directors and Executive Officers as a Group (11 Persons) | 871,099 | 152,802 | 1,023,901 | 5.2 |

| (1) | The economic terms of RSUs are substantially similar to shares of restricted stock. However, because shares of restricted stock carry voting rights while RSUs do not, pursuant to SEC rules shares of restricted stock would be included in the “Total” column, while RSUs are not so included. We show them here because we believe it provides additional information to our shareholders regarding the equity interests our executive officers and directors hold in the Company. |

| (2) | Includes |

| (*) | Less than 1%. |

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, officers and greater than 10% owners to report their beneficial ownership of our common stock and any changes in that ownership to the SEC, on forms prescribed by the SEC. Specific dates for such reporting have been established by the SEC and we are required to report in our proxy statement any failure to file such report by the established dates during the last fiscal year. Based upon our review of the copies of such forms filed electronically with the SECfurnished to us for the year ended September 28, 2019,October 2, 2021, and information provided to us by our directors, officers and ten percent shareholders, we believe that all forms required to be filed pursuant to Section 16(a) were filed on a timely basis.basis, except that a single transaction on one Form 4 for Mr. Wagner was filed late due to administrative error.

| INSTEELINDUSTRIES INC. | | 15 | ||||

Item Number OneElection of Directors

Our bylaws, as last amended December 19, 2016, provide that the number of directors, as determined from time to time by the Board, shall be not less than five nor more than 10, with the precise number to be determined from time to time by resolution of the Board. The Board has most recently set the number of directors at seven. The bylaws further provide that directors shall be divided into three classes serving staggered three-year terms, with each class to be as nearly equal in number as possible.

Accordingly, if elected by our shareholders at this Annual Meeting, Messer’s BoxleyMessrs. Ruth and Rogers and Ms. LloydRutkowski will serve three-year terms expiring at the 20232025 Annual Meeting of Shareholders or until their successors are elected and qualified. Each of the nominees presently serve as our directors. It is not contemplated that any of the nominees will be unable or unwilling for good cause to serve, but if that should occur, it is the intention of the agents named in the proxy to vote for election of such other person or persons to serve as a director as the Board may recommend. If any director resigns, dies or is otherwise unable to serve out his term, or the Board increases the number of directors, the Board may fill the vacancy until the expiration of such director’s term.

The nominees for director will be elected by plurality of the votes cast at the meeting at which a quorum representing a majority of all outstanding Shares is present and voting, either by proxy or in person. This means that the threetwo nominees receiving the highest number of “FOR” votes will be elected as directors. However, pursuant to the charter of our Nominating and Governance Committee and our Board Governance Guidelines, a nominee who receives less than a majority of the votes cast in an uncontested election would be required to submit his or her resignation to the Board. See “Board Governance Guidelines” on p. 11.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS AVOTE FOR THE ELECTION OF EACH OF THE FOLLOWING |

Information Regarding Nominees, Continuing Directors and Executive Officers

We have set forth below certain information regarding our nominees for director, our continuing directors and our executive officers. The age shown for each such person is his or her age on December 11, 2019, the15, 2021, our record date for our Annual Meeting.date.

| Executive | Nominating and | Executive | Nominating and | |||||||||

| Director | Audit | Compensation | Governance | Director | Audit | Compensation | Governance | |||||

| Age | Since | Committee | Independent | Age | Since | Committee | Independent | |||||

| Abney S. Boxley III | 61 | 2018 |  | Y | 63 | 2018 |  | Y | ||||

| Anne H. Lloyd | 58 | 2019 |  |  | Y | 60 | 2019 |  | Y | |||

| W. Allen Rogers II | 73 | 1986 |  |  | Y | 75 | 1986 |  |  | Y | ||

| Jon M. Ruth | 64 | 2016 |  |  | Y | 66 | 2016 |  |  | Y | ||

| Joseph A. Rutkowski | 65 | 2015 |  |  | Y | 66 | 2015 |  |  | Y | ||

| G. Kennedy Thompson | 69 | 2017 |  |  | Y | 71 | 2017 |  |  | Y | ||

| H. O. Woltz III | 63 | 1986 | N | 65 | 1986 | N | ||||||

Chair Chair | ||||||||||||

| Chair |

| www.insteel.com | INSTEELINDUSTRIES INC. | | ||||

Nominees for Directors with terms expiring at the 2025 Annual Meeting

JON M. RUTH

Age 66

Director since: 2016

INDEPENDENT

Mr. Ruth retired from Cargill Incorporated, a global provider of food, agricultural, industrial and financial products and services in August of 2015, following 35 years of service to Cargill. Mr. Ruth served in various senior executive positions with Cargill, most recently as vice president leading its SAP enterprise resource planning implementation across its businesses in Europe and North America from 2005 to 2015, as a director of North Star BlueScope Steel, a joint venture between Cargill and BlueScope Steel from 2004 to 2015, and as President of North Star Steel from 2003 to 2005. Our Board determined that he should continue to serve as director because of his extensive experience as a senior executive of a large multi-national company with specific experience in the steel industry.

Committee Memberships:

| • | Executive Compensation Committee (Chair) |

| • | Nominating and Governance Committee |

JOSEPH A. RUTKOWSKI

Age 66

Director since: 2015

INDEPENDENT

Mr. Rutkowski has been a Principal at Winyah Advisors LLC, a management consulting firm, since 2010. Previously, Mr. Rutkowski spent 21 years at Nucor Corporation (Nucor), the largest steel producer in the United States. Mr. Rutkowski began his career with Nucor in 1989, most recently serving as Executive Vice President of Business Development, International and North America, for Nucor from November 1998 until his retirement on February 28, 2010. He served as Vice President of Nucor from 1993 to 1998 and previously as General Manager of a number of Nucor steel mills. Our Board determined that he should continue to serve as a director because of his extensive background as a senior executive in the steel industry and because he also contributes his experience as a current director of Cenergy Holdings S.A., a Belgian company, and as a former director of Cleveland Cliffs, Inc., a U.S. public company.

Committee Memberships:

| • | Executive Compensation Committee |

| • | Nominating and Governance Committee (Chair) |

Current Directorship:

Continuing Directors with terms expiring at the 2023 Annual Meeting

ABNEY S. BOXLEY, III

Age 6163

Director since:2018

INDEPENDENT

Mr. Boxley has beenwas an employee of Boxley Materials Company sincebeginning in 1980, and has been president and CEO of that company since 1988. Following thefrom 1988 until its acquisition of Boxley Materials Company by Summit Materials Inc., in 2016. Mr. Boxley was appointed President, Eastern Region, of the latter company in December 2018.currently serves as Summit Materials’ Executive Vice President. In addition to our Board, Mr. Boxley serves on the boards of two other public companies: Pinnacle Financial Partners, Inc. and RGC Resources, Inc., as well as on a number of non-profit boards. Our board determined that Mr. Boxley should continue to serve as a director because of his in-depth knowledge of the construction aggregates business, a business that is related to ours, and because he brings to our board his experience as a CEO of a substantial business enterprise and his experience as a director of two other public companies.

Committee Memberships:

| • | Executive Compensation Committee |

| • | Nominating and Governance Committee |

Current Directorships:

| • | Pinnacle Financial Partners, Inc. |

| • | RGC Resources, Inc. |

ANNE H. LLOYD

Age 60

Director since: 2019

INDEPENDENT

Ms. Lloyd served as Executive Vice President and Chief Financial Officer of Martin Marietta Materials, Inc., a publicly traded global supplier of building materials, from 2005 until her retirement in 2017. She joined Martin Marietta in 1998 as Vice President and Controller and was named Chief Accounting Officer in 1999. Ms. Lloyd currently serves as a director of Highwood Properties, Inc., a publicly traded company and as a director of James Hardie Industries p.l.c., an Irish publicly traded company. We believe that Ms. Lloyd should continue to serve as a director because of her financial expertise, her deep knowledge of the construction aggregates business, a business that is related to ours, and because of her extensive public-company experience, including as a director of two other public companies.

Committee Memberships:

| • | Audit Committee |

| • | Executive Compensation Committee |

Current Directorships:

| • | Highwood Properties, Inc. |

| • | James Hardie Industries p.l.c. |

| INSTEELINDUSTRIES INC. | 2022 Proxy Statement | 17 | |||

W. ALLEN ROGERS II

Age 7375

Director since:1986

INDEPENDENT

Mr. Rogers is a Principal of Ewing Capital Partners, LLC, an investment banking firm founded in 2003 and a partner in Peter Browning Partners, LLC, a provider of advisory services to public-company boards. From 2002 to 2003, he was a Senior Vice President of Intrepid Capital Corporation, an investment banking and asset management firm. From 1998 until 2002, Mr. Rogers was President of Rogers & Company, Inc., a private investment banking boutique. From 1995 through 1997, Mr. Rogers served as a Managing Director of KPMG BayMark Capital LLC, and the investment banking practice of KPMG. Mr. Rogers served as Senior Vice President –�� Investment Banking of Interstate/Johnson Lane Corporation from 1986 to 1995 and as a member of that firm’s Board of Directors from 1990 to 1995. He is a director of Ewing Capital Partners, LLC, a private company. Mr. Rogers serves as our Lead Independent Director. Our Board determined that Mr. Rogers should continue to serve as a director due to his expertise in public capital markets, investment banking and finance, some of which is attributable to his participation as an investment banker in our initial public offering, as well as his expertise in public-company governance.

Committee Memberships:

| • | Audit Committee |

| • | Nominating and Governance Committee |

Current Directorship:

ANNE H. LLOYD

Age 58Director since:2019INDEPENDENT

Ms. Lloyd served as Executive Vice President and Chief Financial Officer of Martin Marietta Materials, Inc., a publicly traded global supplier of building materials, from 2005 until her retirement in 2017. She joined Martin Marietta in 1998 as Vice President and Controller and was named Chief Accounting Officer in 1999. Ms. Lloyd currently serves as a director of Highwood Properties, Inc., a publicly traded company, and as a director and interim Chief Financial Officer of James Hardie Industries p.l.c., an Irish publicly traded company. Ms. Lloyd became an Insteel director on April 16, 2019. We believe that Ms. Lloyd should continue to serve as a director because of her financial expertise, her deep knowledge of the construction aggregates business, a business that is related to ours, and because of her extensive public-company experience, including as a director of two other public companies.

Committee Memberships:

Current Directorships:

Continuing Directors with terms expiring at the 20212024 Annual Meeting

H. O. WOLTZ III

Age 6365

Director since:1986

Mr. Woltz hasis our Chairman, President and Chief Executive Officer, having been employed by us and our subsidiaries in various capacities since 1978. He was named President and Chief Operating Officer in 1989, CEO in 1991 and Chairman of the Board in February 2009. He served as our Vice President from 1988 to 1989 and as President of Rappahannock Wire Company, formerly a subsidiary of our Company, from 1981 to 1989. He also serves as President of Insteel Wire Products Company, a current subsidiary of our Company. Mr. Woltz served as President of Florida Wire and Cable, Inc., also formerly a subsidiary of our Company, until its merger with Insteel Wire Products Company in 2002. Mr. Woltz currently serves as our Chairman, President and CEO. He has been an officer of the Companyemployed by us for over 3043 years and has been our President for over 2532 years. Our Board determined that he should continue to serve as a director because he has an intimate knowledge of our products, manufacturing processes, customers and markets, and draws on that knowledge to provide the Board with detailed analysis and insight regarding the Company’s performance as well as extensive knowledge of our industry.

G.G KENNEDY (“KEN”) THOMPSON

Age 6971

Director since:2017

INDEPENDENT

Mr. Thompson retired in April 2019 from Aquiline Capital Partners LLC, a private equity firm investing in the global financial services sector where he had been a partner since 2009. Prior to joining Aquiline, Mr. Thompson was Chairman, President and Chief Executive Officer of Wachovia Corporation, a publicly traded regional bank from 1999 to 2008. Previously, Mr. Thompson was the chairman of The Clearing House, The Financial Services Roundtable and the Financial Services Forum. He is a former president of the International Monetary Conference and was also president of the Federal Advisory Council of the Federal Reserve Board. Mr. Thompson currently serves as a director of two other publicly traded companies: Lending Tree, Inc. and Pinnacle Financial Partners, Inc. We determined Mr. Thompson should continue to serve as a director because of his financial expertise, public company leadership experience and executive management experience.

Committee Memberships:

| • | Executive Compensation Committee |

| • | Audit Committee (Chair) |

Current Directorships:

| • | Lending Tree, Inc. |

| • | Pinnacle Financial Partners, Inc. |

Continuing Directors with terms expiring at the 2022 Annual Meeting

JON M. RUTH

Age 64Director since:2016INDEPENDENT

Mr. Ruth retired from Cargill Incorporated, a global provider of food, agricultural, industrial and financial products and services in August of 2015, following 35 years of service to Cargill. Mr. Ruth served in various senior executive positions with Cargill, most recently as Vice President leading its SAP enterprise resource planning implementation across its businesses in Europe and North America from 2005 to 2015, as a director of North Star BlueScope Steel, a joint venture between Cargill and BlueScope Steel from 2004 to 2015, and as President of North Star Steel from 2003 to 2005. Our Board determined that he should continue to serve as director because of his extensive experience as a senior executive of a large multi-national company with specific experience in the steel industry.

Committee Memberships:

JOSEPH A. RUTKOWSKI

Age 65Director since:2015INDEPENDENT

Mr. Rutkowski has been a Principal at Winyah Advisors LLC, a management consulting firm, since 2010. Previously, Mr. Rutkowski spent 21 years at Nucor Corporation (Nucor), the largest steel producer in the United States. Mr. Rutkowski began his career with Nucor in 1989, most recently serving as Executive Vice President of Business Development, International and North America, for Nucor from November 1998 until his retirement on February 28, 2010. He served as Vice President of Nucor from 1993 to 1998 and previously as General Manager of a number of Nucor steel mills. Our Board determined that he should continue to serve as a director because of his extensive background as a senior executive in the steel industry and because he also contributes his experience as a current director of Cleveland Cliffs, Inc., a publicly traded company, and of Cenergy Holdings S.A., a Belgian company.

Committee Memberships:

Current Directorships:

| INSTEELINDUSTRIES INC. | | |||||

Executive Officers Who Are Not Continuing Directors or Nominees

In addition to Mr. Woltz, the executive officers listed below were appointed by the Board of Directors to the offices indicated for a term that will expire at the next annual meeting of the Board of Directors or until their successors are elected and qualify. The next meeting at which officers will be appointed is scheduled for February 11, 2020,15, 2022, at which each of our executive officers is expected to be reappointed.

Michael C. Gazmarian,Mark A. Carano, 60, joined us in 199452, has served as Treasurer and Chief Financial Officer. In February 2007, he was electedSenior Vice President, Chief Financial Officer and Treasurer.Treasurer since October 2020, and as Vice President, Chief Financial Officer and Treasurer since joining us in May 2020. Before joining us, Mr. GazmarianCarano had been employed by Guardian Industries Corp.,Big River Steel, a privately-held manufacturer of glass, automotive and buildingsteel products, having served as Chief Financial Officer since 1986, servingApril 2019. Prior to Big River Steel, he served in various financial capacities.senior management finance roles with Babcock & Wilcox Enterprises from June 2013 to October 2018. Mr. Carano also has 14 years of combined investment banking experience with Bank of America, Merrill Lynch, Deutsche Bank and First Union Securities.

James F. Petelle, 69,71, has served as Vice-President-Administration, Secretary and Chief Legal Officer since October 2020. He joined us in October 2006. He2006 and he was elected Vice President and Assistant Secretary in November 2006 and Vice President - Administration and Secretary in January 2007. Previously heHe was previously employed by Andrew Corporation, a publicly-held manufacturer of telecommunications infrastructure equipment, having served as Secretary from 1990 to May 2006, and Vice President –- Law from 2000 to October 2006.

Richard T. Wagner,60, 62, has served as Senior Vice President and Chief Operating Officer since October 2020. He joined us in 1992 and has served as Vice President and General Manager of the Concrete Reinforcing Products Business Unit of the Company’sour subsidiary, Insteel Wire Products Company, since 1998. In February 2007, Mr. WagnerHe was appointed Vice President of the parent company, Insteel Industries Inc., in February 2007. From 1977 until 1992, Mr. Wagner served in various positions with Florida Wire and Cable, Inc., a manufacturer of PC strand and galvanized strand products, thatwhich was later acquired by us in 2000.

Item Number TwoJames R. York,Approval 63, has served as Senior Vice President, Sourcing and Logistics since October 2020 and as Vice President, Sourcing and Logistics since joining us in 2018. Prior to Insteel, he served in various senior management roles with Leggett & Platt, a publicly-held manufacturer of an Amendmentdiversified engineered products, from 2002 to the 2015 Equity Incentive Plan2018, including Group President-Rod and Wire Products, Unit President-Wire Products and Unit President-Specialty Products. Mr. York served in a range of Insteel Industries Inc.leadership positions at Bekaert Corporation, A U.S. subsidiary of N.V. Bekaert A.S. of Belgium, from 1983 to 2002.

The Board of Directors, upon the recommendation of the Executive Compensation Committee and in consultation with our management and our independent compensation advisor, is requesting that shareholders approve an amendment to the 2015 Equity Incentive Plan of Insteel Industries Inc. (the “2015 Plan”) to increase by 750,000 shares of common stock (subject to adjustment as provided in the 2015 Plan) the total number of shares authorized for issuance under the 2015 Plan. Of the additional authorized shares, only 250,000 shares (subject to adjustment as provided in the 2015 Plan) could be used for “full-value” grants, that is, for restricted stock, RSUs or performance awards. In addition, the amendment would limit the number of shares that may be used for incentive stock options (“ISOs”) under the 2015 Plan to 400,000 shares. On November 12, 2019, the Board approved these amendments to the 2015 Plan, subject to approval of our shareholders. On the same date, the Board also approved certain other immaterial amendments to the 2015 Plan, which amendments are not subject to shareholder approval. A summary of the 2015 Plan, including the amendments described above, is set forth below. The summary is qualified in its entirety by reference to the full text of the 2015 Plan (including the 2019 Declaration of Amendment attached thereto), a copy of which is attached as Annex A to this Proxy Statement.

The 2015 Plan, as approved by our shareholders on February 17, 2015, initially reserved 900,000 shares of common stock for issuance. As of September 28, 2019 (the last day of our fiscal 2019), there were 142,897 shares remaining available for issuance under the 2015 Plan of which 109,124 may be granted as “full-value” awards. Also, as of that date, there were outstanding stock options for 388,483 shares with a weighted average remaining term of 7.81 years, and 114,396 outstanding RSUs that, upon vesting, are convertible into an equivalent number of shares of common stock. There were 19,260,725 shares of common stock outstanding as of September 28, 2019.

We do not believe that the 142,897 shares of stock available for issuance under the 2015 Plan are sufficient to continue implementing our long-term incentive program. Accordingly, subject to shareholder approval, the Board authorized an increase in the number of shares authorized for issuance under the 2015 Plan to a total of 1,650,000 shares (subject to adjustment as provided in the 2015 Plan). The 2015 Plan is the only equity compensation-based program maintained by the Company, and the awards we provide under the 2015 Plan are the only long-term incentives we provide to executives (i.e., we do not currently maintain a long-term incentive cash compensation program).

If this proposal is not approved by the shareholders, the proposed additional 750,000 shares will not become available for issuance under the 2015 Plan, but the 2015 Plan will otherwise remain in effect.

Plan Features That Protect Shareholder Interests

The 2015 Plan, as amended, contains several features that are intended to protect the interests of our shareholders. The more prominent of these include:

Independent Plan Administration

The Executive Compensation Committee, comprised solely of non-employee, independent Directors, administers the 2015 Plan.

No Re-pricing

The Company may not reprice any outstanding option (or cancel and regrant a new option with a lower option price) without shareholder approval.

No Discounted Options

Options may not be granted with exercise prices below market value.

| INSTEELINDUSTRIES INC. | | |||||

No Dividend or Dividend Equivalents on Unearned Performance Based Awards

Dividends and dividend equivalents, if any, on unearned or unvested performance based awards may not be paid (even if accrued) unless and until the underlying award (or portion thereof) has vested or been earned.

Limit on Full-Value Awards

Of the 750,000 additional shares for which authorization is sought, no more than 250,000 may be used for “full-value” awards (restricted stock, RSUs and performance awards), which would increase the limit for “full-value” awards under the 2015 Plan to 600,000.

Limit on ISOs

In addition to the limit on full-value awards, we are proposing that a 400,000 share limit on the number of ISOs issuable under the 2015 Plan also be adopted.

Conservative Share Counting

The 2015 Plan provides that shares (i) surrendered by a participant to pay the option exercise price, or (ii) withheld by the Company to satisfy tax withholding requirements may not be added back to the pool of shares authorized for future issuance. In addition, shares purchased on the open market with proceeds of stock option exercises may not be added back to the pool of shares available under the 2015 Plan.

Minimum Vesting Provisions

Awards granted to employees under the 2015 Plan will not fully vest (i) in less than three years for service-related vesting (which may include installment vesting within such three-year period, provided that no portion of the Award may vest prior to one year after the date of grant), or (ii) in less than one year for performance-related vesting. Awards granted to non-employee directors also may not vest in less than one year. However, in the case of Awards to either employees or directors, acceleration of vesting would be permitted in the case of retirement, disability, death, or qualifying termination following a change in control.

Why You Should Vote for the Amendment of the 2015 Plan

We believe that the 2015 Plan is important to our growth and success. The purpose of the 2015 Plan is to attract, motivate and retain highly qualified officers, directors and key employees. We believe that providing these individuals with an opportunity to acquire a direct proprietary interest in the operations and potential future success of the Company will motivate these individuals to serve the Company and its shareholders by expending the maximum effort to improve our business and results of operations. We believe that equity award grants under the 2015 Plan are a valuable incentive to participants and benefit shareholders by aligning more closely the interests of participants with those of our shareholders. We ask shareholders to consider the following factors and to vote for the proposed amendment of the 2015 Plan:

Equity incentive awards are an important part of our overall compensation philosophy

The 2015 Plan is critical to our ongoing effort to build shareholder value. Equity incentive awards have historically been and remain a critically important component of our compensation program. Our Executive Compensation Committee believes that our ability to grant equity incentive awards to employees is an important factor in our ability to attract, retain and motivate key employees. The Committee believes that equity compensation provides a strong incentive for employees to work to expand our business and build shareholder value. Moreover, equity awards made under the 2015 Plan to our senior executives reflect the Committee’s “pay for performance” philosophy since the value received by participants is contingent on Company performance.

The 2015 Plan is a critical component of our compensation program’s goal to attract, motivate and retain the officers and key employees who drive our success

We believe that the remaining shares in the 2015 Plan are insufficient to meet our future compensation objectives. We believe we must continue to offer a competitive equity compensation plan in order to attract and motivate our workforce. If the 2015 Plan were to run out of shares available for grant, we would not be able to issue additional equity awards. While we could consider modifying our cash compensation program if we are unable to grant equity incentives, we believe it would be more prudent

to conserve our cash so it will be available for future growth opportunities. We also believe that any inability to award equity compensation would result in difficulty in attracting, retaining, and motivating our employees. Equity-based awards are a key element of our overall compensation program because they align employee and shareholder interests while having a smaller impact than increased cash compensation would have on current income and cash flow.

We manage our equity incentive award use carefully

The Committee carefully monitors our total dilution, burn rate and equity expense to ensure that we maximize shareholder value by granting what the Committee believes is the appropriate number of equity awards necessary to attract, reward and retain employees.

The following is a summary of the material features of the 2015 Plan, as amended by the 2019 Declaration of Amendment.

The selection of eligible recipients who may receive awards under the 2015 Plan, and the size and type of awards subject to issuance, will be determined by the Administrator in its discretion and in accordance with the terms of the 2015 Plan. Therefore, it is not possible to predict the future benefits or amounts that will be received by, or allocated to, particular individuals or groups of participants in the future. The number of shares of our stock subject to stock options and awards of RSUs granted in fiscal 2019 to our executive officers is set forth below in the table entitled “Fiscal 2019 Grants of Plan-Based Awards.” The targeted value of long-term incentives (stock options and RSUs) to be granted to our executive officers in fiscal 2020 is set forth below under the heading “Long-Term Incentives” in the “Compensation Discussion and Analysis” section of this proxy statement. In addition, the number of shares subject to options and restricted awards granted (without regard to vesting or exercise) under the 2015 Plan since its inception is as follows:

The 2015 Plan is designed to be administered by the Executive Compensation Committee, which will at all times be composed of at least three directors, all of whom are “non-employee directors” within the meaning of Rule 16b-3 promulgated under Section 16(b) of the Exchange Act and (ii) “independent directors” within the meaning of applicable stock exchange listing standards on which shares of the common stock are traded. To the extent permitted by applicable law, the Executive Compensation Committee is permitted to delegate to one or more executive employees the ability to make awards to participants who are not “Section 16 officers.” In such case, the Executive Compensation Committee shall fix the maximum aggregate amount of awards and the maximum individual amount of awards that the designee can award.

To the extent consistent with the 2015 Plan, the Executive Compensation Committee may (i) determine the individuals to receive awards, the nature of each stock option as an ISO or a nonqualified stock option (“NQSO”), the times when awards shall be granted, the number of shares to be subject to each award, the exercise price of stock options, the period during which stock options may be exercised, the time or times when each award shall vest and be exercisable or payable, and all related terms, conditions, restrictions and limitations; (ii) prescribe the form or forms of any award agreements; (iii) establish, amend and rescind rules and regulations of the administration of the 2015 Plan; and (iv) construe and interpret the 2015 Plan, the rules and regulations, and the award agreements, and to make all other determinations deemed necessary or advisable for administering the 2015 Plan. Subject to the terms of the 2015 Plan, the Administrator also has authority, in its discretion, to accelerate the date that any award which was not otherwise exercisable, vested or payable shall become exercisable, vested or payable in whole or in part. All expenses of administering the 2015 Plan will be borne by the Company.

Only key employees of the Company and Related Companies and non-employee directors of the Company are eligible to receive awards under the 2015 Plan. The Administrator will determine which employees will participate in the 2015 Plan, based on criteria set forth in the 2015 Plan and such other factors as the Administrator deems relevant. As of December 31, 2019, there were nine key executives who receive regular, twice-yearly equity awards under the 2015 Plan, and six non-employee directors who receive yearly equity awards under the 2015 Plan. However, the Company periodically makes non-regular awards to other key employees. At this time, six non-employee directors and approximately 50 employees (including our executive officers) are eligible to participate in the 2015 Plan.

The 2015 Plan allows the Administrator to grant stock options, restricted stock, RSUs and performance awards, any or all of which may be made contingent upon the achievement of performance criteria. Subject to plan limits, the Administrator has the discretionary authority to determine the size of an award.

Non-Employee Director Awards

Non-employee directors will receive an annual grant of such number of stock options, shares of restricted stock, RSUs, or other forms of long-term compensation available under the 2015 Plan as the Board of Directors, in its sole discretion, shall determine. Such annual grants are made following the close of business of the Company on the date of each annual meeting of shareholders held during the term of the 2015 Plan. In addition, the Administrator will have discretion to grant awards to any non-employee director who is appointed or elected to the Board of Directors at any time other than at the annual meeting of shareholders. Non-employee directors who were serving on our Board on February 12, 2019 were each granted 2,782 RSUs, having a grant-date value of $60,008, under the 2015 Plan.

Stock Option Awards

Under the 2015 Plan, the Administrator may award participants stock options in such numbers, upon such terms and conditions and at such times as the Administrator may determine. The exercise price of stock options granted under the 2015 Plan may not be less than the fair market value of our common stock on the date of grant, which as of September 27, 2019 (the last trading day of our fiscal 2019) was $20.71 per share. Stock options granted under the 2015 Plan will expire not more than 10 years from the date of grant, and the award agreements entered into with each participant will specify the extent to which stock options may be exercised during their respective terms, including in the event of the participant’s death, disability or termination of employment. A grant may provide for the accelerated vesting of stock options in the event of a termination of employment or a change in control of the Company or any other similar transaction or event.